Achieve Financial Stability for Your Business HNB Finance: A Case Study

HNB Finance works with Sri Lankan individuals to help them start new businesses and improve their financial situation. Technology is a critical business enabler. By redesigning its digital platform, HNB Finance significantly improves operational effectiveness, lowers loan costs, improves customer satisfaction, and sustains ongoing business growth.

Learn how HNB Finance uses HPE storage and server infrastructures to provide Sri Lankans with cutting-edge, technology-driven financial solutions that will assist them in starting businesses and improving their personal finances.

Overview of HPE & HNB Finance Case Study

The HPE & HNB Finance Case Study provides an overview of the various financial options and procedures multinational corporations use to maintain stable financial performance. This case study examines two companies’ financial strategies for navigating difficult economic times while maintaining their competitive edge.

The case provides a thorough examination of HPE and HNB Finance’s financial practices, including the implementation of a business transformation process, the use of outside financial expertise, and the investigation of novel financing options. It also examines how businesses handle complex regulatory issues and use data-driven insights to guide decisions. Through this study, readers can learn more about the strategies two top companies use to succeed in current and future financial markets.

How Businesses Can Achieve Financial Stability

Businesses must have stable finances to succeed. Financially stable businesses can lay a strong foundation for their future. There are several ways for businesses to achieve financial stability.

The first step is to develop a precise, up-to-date budget. It enables businesses to keep track of their costs and revenues, identify areas for cost reduction, and effectively manage their cash flow.

To reduce their debt, businesses should also set clear goals for how much they are willing to borrow and how quickly they will repay it. Businesses can reduce debt payments by frequently reevaluating interest rates and negotiating with creditors.

Businesses can use hedging techniques and steps to diversify their investment portfolios to protect themselves from losses in volatile markets. Diversification reduces the risk of financial difficulty if one source of income disappears by ensuring that income comes from multiple sources.

Benefits of Financial Stability for Businesses

Do you ever consider how crucial monetary stability is to businesses? It’s undeniably not a popular topic but it can make or break a new business venture. Any business must be financially stable to have the resources to sustain and expand operations.

If you control your finances, your company can weather any storm. Please continue reading to find out why it’s critical to keep an eye on your finances as we look at some of the benefits of financial stability for businesses.

Improved Cash Flow

Financial stability indicates that the cash flow of a company is under control. Every cent earned is recorded, and any loans are promptly repaid. It makes it much easier to track how much money you have available and how to use it to grow your business.

Increased Profitability

Financial stability boosts profitability because it allows you to make wise financial decisions. You’ll be able to manage your spending better, prioritize debt repayment, and invest in valuable assets that will generate income.

Reduced Risk of Insolvency

When a company’s finances are stable, it is much less likely to go bankrupt. If your finances are in order, you are less likely to deal with unforeseen expenses or debts that could put your business into a tailspin. You can avoid this disastrous outcome by implementing financial stability measures.

Elevating Livelihoods

Capital is critical for the survival of both large and small businesses. However, millions of inventive and diligent business owners cannot secure the funding they require to expand their enterprises due to their low income and lack of credit histories. Microfinance allows people to obtain small, manageable loans to start and expand their businesses. It is a viable and frequently life-changing option. HNB Finance began offering microfinancing options in Sri Lanka nearly 20 years ago. The company has since improved people’s lives and the country’s economy.

Over the last 20 years, HNB Finance has grown beyond the microfinance industry to become a full-service financial institution. Home mortgages, traditional personal and business loans, fixed-rate deposits, gold loans, and savings accounts are now available from the company. HNB Finance has also evolved into a technology-driven organization.

Improved end-user experience

Because technology is so vital to HNB Finance’s internal processes and customer-facing services, the performance and availability of the IT infrastructure are critical. Direct customer service provided by bank tellers, field staff beginning a small business loan application process, and homeowners making mortgage payments all relies on access to digital services. However, the company’s infrastructure was being stretched to its breaking point as the business expanded.

By transforming its infrastructure with intelligence-driven technologies, HNB Finance increased the uptime and performance of its critical applications, which handle everything from loan origination to online banking.

Leveraging intelligent tech to work smarter

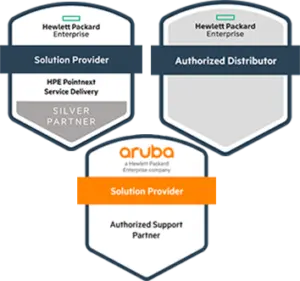

HNB Finance needed to transform its technology foundation into a customer-focused company with a vision of leading Sri Lanka in creative financial solutions that improve people’s lives and livelihoods throughout the country. In collaboration with his local technology partner NetSys Solutions and HPE distributor Plexus Global, Mr Dias designed and implemented a new IT infrastructure based entirely on Hewlett Packard Enterprise hardware, including HPE ProLiant DL380 Gen10 servers, HPE Primera mission-critical storage, and Aruba networking. HNB Finance also uses HPE StoreOnce to back up its databases and applications.

Mr Dias employs HPE InfoSight, which provides predictive analytics, to gain the intelligence and visibility required to anticipate service faults and improve the infrastructure’s health and performance.

Smooth operations for staff and customers

Building a new solid infrastructure has eliminated periodic system issues that previously disrupted business operations. According to Mr Dias, the infrastructure and the applications it supports have been fully operational since they were installed.

Final Thought

Thanks to HPE and HNB Finance, businesses now have the tools to achieve financial stability. As demonstrated by this case study, their financial solutions can be tailored to the specific needs of each business. Businesses can reduce their financial burden and ensure they are on the right track by implementing the right strategies. Begin securing your financial future today by allowing HPE and HNB Finance to assist you in meeting your financial goals.

ICT Distribution Sri Lanka sells a wide range of HPE products, including server, storage, networking, and software solutions. Our team will provide the most excellent service and help to our customers. So, what’s keeping you waiting? Reach out to our business manager, Rukshana rukshana.buhardeen@ictdistribution.net

Latest Posts

Beyond Antivirus: Why Kaspersky Total Security is Your 2024 Digital Guardian